Visa - Pyramids, Partnerships, and Choice: In Praise of an Open Payments Ecosystem

Posted on Jun 25, 2021 by Chad Harper, Global Payments Fellow, Visa Economic Empowerment Institute and Roeland Van der Stappen, VEEI Fellow and Head of Regulatory Affairs for Europe, Visa

The Pandemic-Accelerated Digital Transformation is Likely Here to Stay

The global COVID-19 pandemic has brought deep sorrow, frustration, and anxiety to most of the world. Given the loss of life, one cannot say there were silver linings. There were perhaps mitigants—capabilities and technologies that allowed some aspects of life and commerce to continue on and prevent a bad situation from becoming much worse for consumers, small businesses, and the families of migrant workers. E-commerce was already ascendant before COVID-19, and as the pandemic unfolded it enabled commerce to continue seamlessly and securely. For transactions that could still happen in-person, contactless became a new normal.[1]

Visa Economic Empowerment Institute (VEEI) research found that small businesses which were digitally enabled and connected to global and regional marketplaces fared better than firms that were not; these digitally enabled and connected firms were also more optimistic for the future. VEEI also found that digital remittances proved invaluable for migrant workers sending money home to families, and these remittances also demonstrated the power of innovation and global networks to reduce costs and improve speed and transparency. We salute the migrant workers themselves, who were able to navigate significant economic disruption and job loss in G20 countries to defy expectations and send much more money home to families in low- and middle-income countries (LMICs) in 2020 than originally expected.[2]

We believe that this shift to digital is likely here to stay in most parts of the world.

Payments will become more embedded in experiences, and more invisible. People and small businesses that are not digitally enabled will face challenges experiencing life and commerce in the same way as those who are. The shift to digital was so impactful, and so necessary, for people and small businesses that it has understandably energized and focused policymaker attention on the future of money and payments. While many countries are already working on further deployment of faster account-to-account payment solutions, the shift to digital has generated increased interest in exploring retail central bank digital currencies (CBDCs) and improving cross-border payments.

All of this gives rise to some questions around the roles of the public and private sectors, and how we can best work together to enable everyone, everywhere to fully participate in digital life.

Resilience and Security are Fundamental—They are the Base of the Payments Pyramid

Innovation in payments is accelerating to meet changing needs. This is exciting, and it also requires the private and public sectors to ensure that these developments are inclusive, sustainable, and maintain trust and financial stability. But what is trust built on?

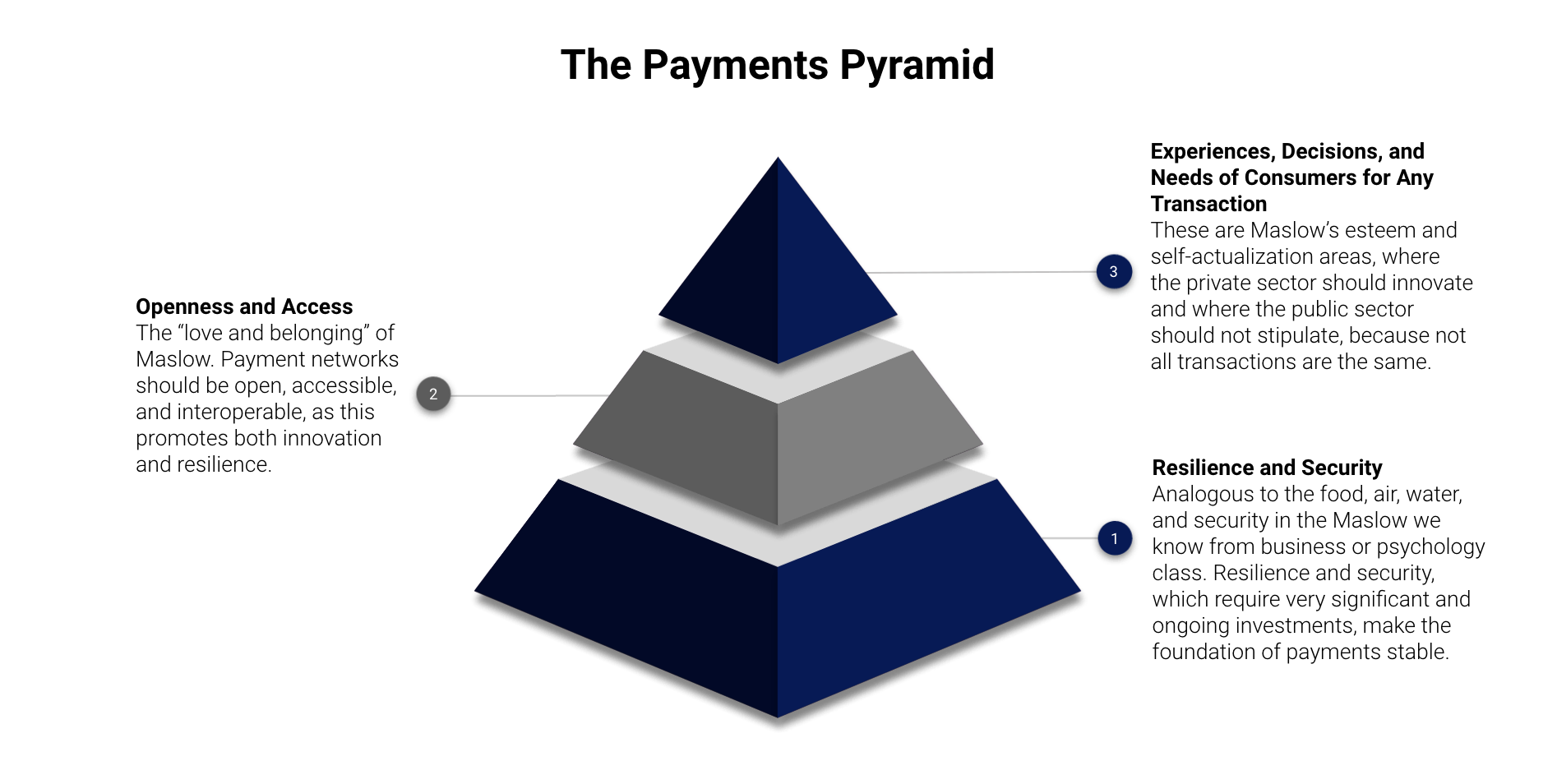

At Visa, for more than six decades we have been enabling international acceptance, resilience, fraud protection, and consumer protection—so we have a view. One way to think about trust is through a payments version of “Maslow’s hierarchy.”[3]

At the base of the pyramid are resilience and security—analogous to the food, air, water, and security in the Maslow we know from business or psychology class. Resilience and security, which require very significant and ongoing investments, make the foundation of payments stable. While the private sector has done a good job of providing secure and resilient payments, it is appropriately within the purview of policymakers to define the aspirations and expectations at the base of the pyramid.

Openness and access come next—they are the “love and belonging” of Maslow. Payment networks should be open, accessible, and interoperable, as this promotes both innovation and resilience. Central banks and policymakers should encourage this, for example by providing access to central bank payment and settlement systems for non-banks, and by supporting greater interoperability—whether it be technical, network, or regulatory. All are important, though perhaps regulatory interoperability is most pressing to focus on, since it can enable the other two. Achieving interoperability—rather than striving for uniformity—avoids creating the single points of failure that are so inherently damaging to the base of the pyramid.[4]

At the top of the payments pyramid sits the ability of payments to support the experiences, decisions, and needs of consumers for any transaction—Maslow’s esteem and self-actualization areas. This is where the private sector should innovate and where the public sector should not stipulate, because not all transactions are the same. On the metro, a rider wants an authorization in milliseconds in order to go through the turnstile without breaking pace. For a teenager out shopping, a parent perhaps wants control over spending. For sending money home across borders, a person wants low cost, speed, and certainty. But for a cross-border e-commerce purchase or booking a summer vacation, a consumer wants purchase protections.

This brings us to some areas where the public and private sectors can and should work together to improve outcomes for people and small businesses.

Instant Payments Need to be Part of a Diverse Digital Payments Mix

The market for instant payments is advancing, driven by technological development, consumer and business demand, and support from policymakers. Some fifty countries have already implemented account-to-account faster payment systems, and a couple dozen more are working on it. Instant payments are complementary to other payment types and bring unique features and value propositions. But faster payments would not be the preferred method for all of the use cases mentioned in the previous section.

A diverse payments mix will be needed to allow for continued competition and innovation. Instant settlement is only one feature consumers may care about, and even then, many care more about instant funds availability. That said, instant payments may facilitate a variety of use cases people and businesses care about, and the overlay services that they need to be attractive to end users will benefit from private sector innovation. The private sector has much to add in the way of security and fraud know-how as well—in real time payments, fraud can move quickly.

Private Sector Involvement in Retail CBDCs is Essential for Innovation and Financial Stability

A retail CBDC which addresses clear market needs and is complementary to existing private digital payments could be a valuable part of a diverse payment landscape. However, depending on the eventual design, a retail CBDC could fundamentally change the role of central banks, payment service providers, and payment networks. Central bankers are understandably taking the lead here—providing currency, whether physical or digital, is a core central bank activity and one where the operator role is natural.

We do believe strong support from the private sector is key for the success of a retail CBDC. The private sector is well-situated to help sort out the natural use-cases for instant payment and CBDCs, given its strong knowledge of consumer and business preferences and behaviors. Again, central banks should continue to focus on the foundational elements—security and certainty of acceptance—while intermediaries are best placed to deliver against these objectives and also to provide the best possible user experience.

CBDC design choices should favor openness and interoperability. We generally believe that retail CBDCs should be integrated into the existing payments ecosystem as this will, among other things, ensure customers are provided with integrated payments solutions and acceptance is widespread from initial introduction.

Strong Public-Private Partnership is Needed to Improve Cross-Border Payments

The case of digital remittances demonstrates that digital business models and newer global money movement networks can reduce costs—digital remittances are indisputably less costly than cash-initiated ones.[5] Newer global money movement networks, or even a “network of networks” can also improve speed and transparency. Cross-border money flows do not lack for innovative infrastructure, but there are a variety of things policymakers can do to help the private sector move money more efficiently, securely, and inclusively.

We understand the need and desire for countries to exercise sovereignty over their monetary and payments systems. But sovereignty that places localism above the resilience and security of its payments networks may damage trust and weaken financial stability. For payments to move freely across borders, data has to do the same. This does not mean things have to be less secure—quite the opposite. For something like fraud, global information is a key to protecting citizens. Fraudsters do not respect geographic boundaries.

Cyber security benefits from global data and the ability to move at lightning speed, day or night. Cross-border payments also encounter a variety of regulatory regimes on their journey, and this adds friction. We are pleased that the Financial Stability Board’s Roadmap to Enhance Cross-Border Payments calls for greater coordination here.

Lastly, payments innovators who wish to bring new products and capabilities to market must navigate vastly different license requirements around the globe, and this takes resources and adds costs to solutions. Policymakers can help the private sector achieve the roadmap’s objectives by working with it on these issues, and we believe this partnership is off to a good start since the roadmap was published.

Conclusion

Payments innovation follows the lead of commerce. For payments to be “one size fits all,” commerce would have to follow a set pattern—we know it does not. When one considers the innovations in retail, in-app, person-to-person, and government-to-citizen payment flows over the past five years, it becomes clear that change is the only constant. The pandemic accelerated that change. Central banks and policymakers should therefore promote a diverse and open payment landscape where all players commit to security and resilience, and where consumers and merchants can choose the most suitable payment method depending on the use case.

About the Authors

Chad Harper is Global Payments Fellow in the Visa Economic Empowerment Institute. He previously spent nearly 20 years at the Federal Reserve Banks of San Francisco, Chicago, and Richmond in cash, financial services, and payments outreach and analysis.

Roeland Van der Stappen is Head of Regulatory Affairs for Europe at Visa and is also a VEEI fellow. He has been working in the financial sector for more than 10 years, including as Vice President of Government Policy and Public Relations at Barclays where he has been an active contributor on digital banking and FinTech policy issues.

[1] The April 27, 2021 Visa Inc. earnings call offered some statistics on e-commerce and contactless. Visa’s growth in card-not-present payments volume excluding travel has averaged at least 30 percent in the United States, Canada, Brazil, United Kingdom, Italy, Germany, India, and Singapore over the last three quarters. In Europe, less than a year since contactless limits increased across the region, Visa has seen 1 billion additional touch-free transactions.

[2] Despite early expectations of a 20 percent drop in remittances to LMICs, the 2020 total was only about 2 percent down from 2019 levels. “Remittances during the COVID-19 Crisis: Resilient and no longer small change.” https://blogs.worldbank.org/peoplemove/remittances-during-covid-19-crisis-resilient-and-no-longer-small-change

[3] Visa Europe CEO Charlotte Hogg started using the Maslow analogy in March 2021 at a CPMI-sponsored cross-border payments conference, and the authors have been fans ever since.

[4] One real-world example of interoperability can be found in Visa’s push payments platform—Visa Direct—which, from October 1, 2019 to September 30, 2020, completed nearly 3.5 billion transactions involving 16 card-based networks, 65 domestic ACH schemes, seven faster payment schemes, and five payment gateways.

[5] See the new Q1 2021 “Remittance Prices Worldwide Quarterly” from the World Bank at https://remittanceprices.worldbank.org/en